Target Savings Goal Calculator Unveiled: A Comprehensive Guide to Navigating Financial Success

The Target Savings Goal Calculator emerges as your digital ally, turning financial dreams into tangible achievements. In this all-encompassing guide, you will explore the secrets of these calculators with dynamic benefits, navigating limitations, and pro tips for optimal usage.

Target Savings Goal Calculator:

This is not just a tool for calculating numbers. It’s your financial architect. It helps you craft plans and gives you ideas for considering your goals, timeframes, and savings.

Target Savings Goal Calculator Features:

Crystal-Clear Vision:

Experience the empowerment of a clear roadmap, enhancing focus and motivation with visual progress tracking that transforms abstract goals into concrete milestones.

Realism in Planning:

Avoid the pitfalls of over-optimism. This calculator brings realism to your financial plans, aligning your savings targets with achievable milestones.

Visualization Beyond Numbers:

Beyond raw data, enjoy the visual feast of graphs and charts, transforming your financial journey into an engaging and understandable experience.

How to Use Target Savings Goal Calculator?

Do you have a savings goal in mind? For a wedding, vacation, car, or house deposit? Or, probably, all you want is a specific amount of money set aside for a rainy day.

Reaching your savings objectives can be challenging, but having a well-defined strategy makes the process even more manageable.

You can use the Target Savings Goal Calculator to know how much you’ll need to save every week, month, or fortnight to meet your savings target on time.

Define Your Goal Clearly:

First, design an outline of your savings goal. Then, please Specify the amount you want to save and the timeframe within which you want to achieve it. This clarity forms the foundation of your savings plan.

Review and Adjust:

Regularly review the recommendations generated by the calculator. Life circumstances and financial goals may change, so be prepared to adjust your savings plan. Flexibility is critical to staying on course.

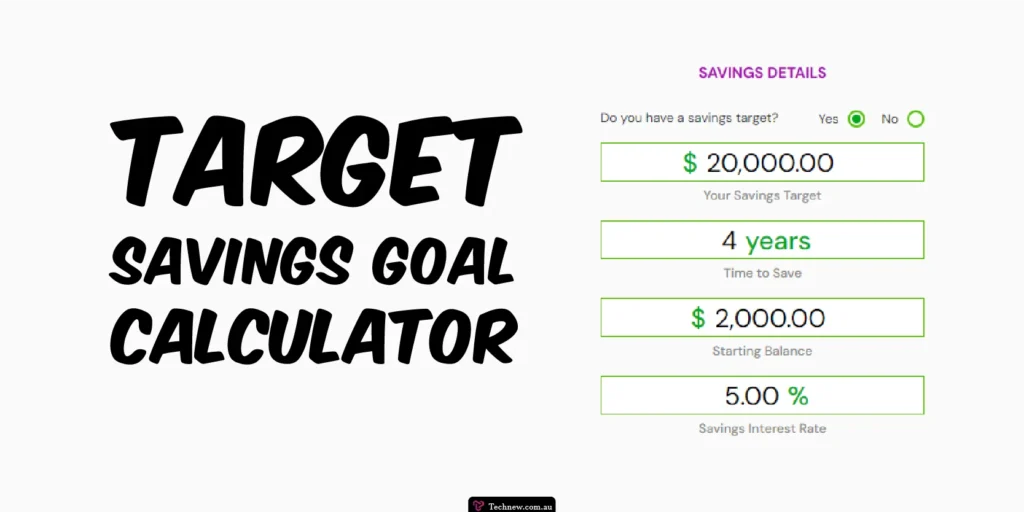

To calculate the targeted savings amount, Enter the following details in the calculator:

- Your savings amount.

- Your time frame for saving (the period of your savings objective).

- Your initial bank balance.

- The interest rate on your savings account.

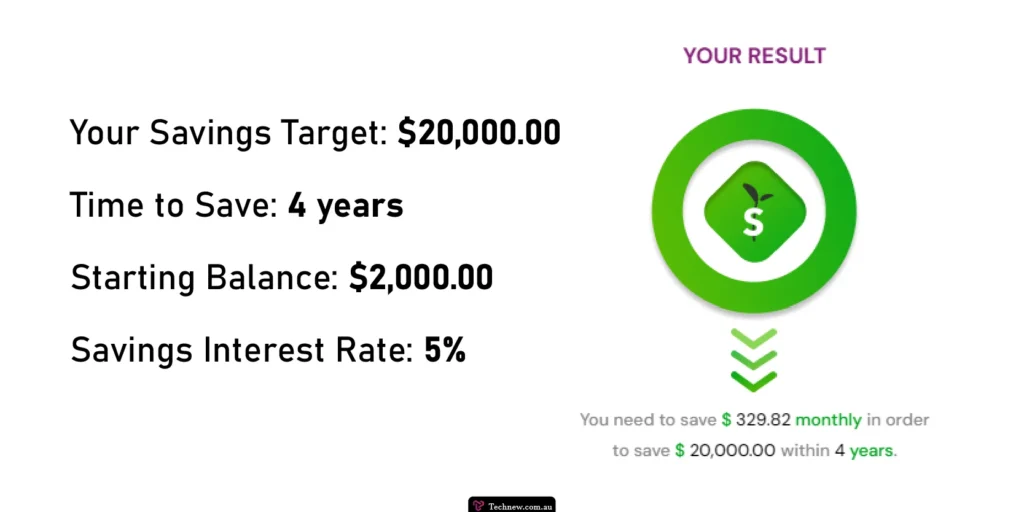

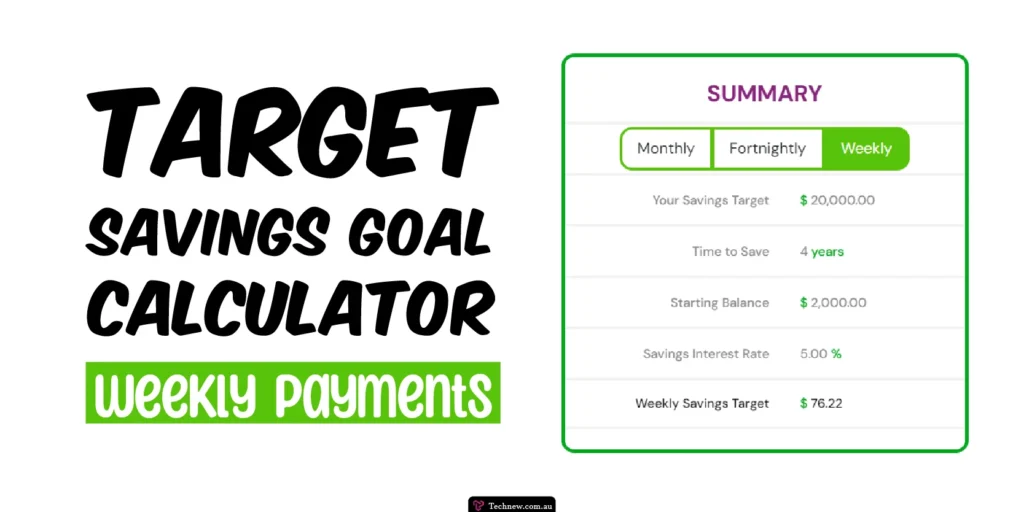

For instance, if you have $2,000 in a savings account with a 5% annual percentage rate and want to save $20,000 in four years, you would need to deposit $329.82 monthly to meet your goal.

Meanwhile, you are allowed to choose weekly, fortnightly, and monthly goals. It will calculate your savings amount accounting for the duration of your time.

Limitations of Target Savings Goal Calculator

Market Fluctuations:

If your savings goal extends over the long term and involves investments, keep an eye on market changes. These calculators can’t predict how economic fluctuations might impact your returns. Stay informed about market trends and be prepared to adapt your savings plan accordingly.

Not Crystal Balls:

While it is a powerful tool, it’s important to remember it’s not a crystal ball. It relies on assumptions and estimates to create your savings plan. Real life can be unpredictable, so be open to adjusting your financial strategy as needed.

Target Savings Goal Calculator Considerations

Emergency Fund:

Before reaching for the stars, establish a financial safety net. An emergency fund ensures your savings plan is shielded from unforeseen economic storms.

Regular Course Corrections:

Life is dynamic, and so should your financial plan. Regular reviews and adjustments ensure your savings strategy evolves in sync with your circumstances.

Pro Tip

Sail with Automation

Set your savings on autopilot with automated transfers. It ensures consistency and eliminates the risk of missed contributions.

Explore Investment Horizons

Diversify your savings through low-risk investments, potentially amplifying returns while safeguarding your principal.

Cheers to Milestones

Celebrate every victory, no matter how small. Recognizing and reveling in milestones keeps the financial journey exciting and fuels the pursuit of larger goals.

Regular Check-Ins:

Life is dynamic, and so are your finances. Regularly review and adjust your savings plan to reflect changes in your income, expenses, or financial goals. This proactive approach ensures that your financial strategy remains relevant and achievable.

FAQs:

How Target Savings Goal Calculator bring clarity to my financial goals?

Can Target Savings Goal Calculator help me to set achievable goals?

What if I don’t have any existing savings?

Final Verdict:

Target Savings Goal Calculators emerge as the unsung heroes of your financial world. Remember, financial dreams become reality when powered by a strategic savings plan, and these are the magic wand that makes it all happen.

Similar Posts

Comparison of Oil-Based Perfumes and Regular Perfumes

How Can MyFlexBot Revolutionize Your Workplace Efficiency?

The Dell XPS 13: A Review of Its Features and Pros and Cons