Navigating The Short Term Loan Market: Understanding Your Options

| In the maze of financial choices, clarity on short term loans is vital for informed decisions when managing unexpected expenses. |

When it comes to navigating the financial world, there is much to consider. The right financial products can differentiate between financial security and financial distress. One of the many options consumers have is the short term loan market. This market can be complicated, so it’s essential to understand your options and what they mean for your financial future.

Basics of Short Term Loan:

| Short-term loans are small amounts borrowed at high interest. |

Short term loans are typically small amounts of money you borrow at a high-interest rate. Along with the agreement that you will pay the loan back, including the interest, within a short period. This term is typically around 30 days, hence the name “short term.”

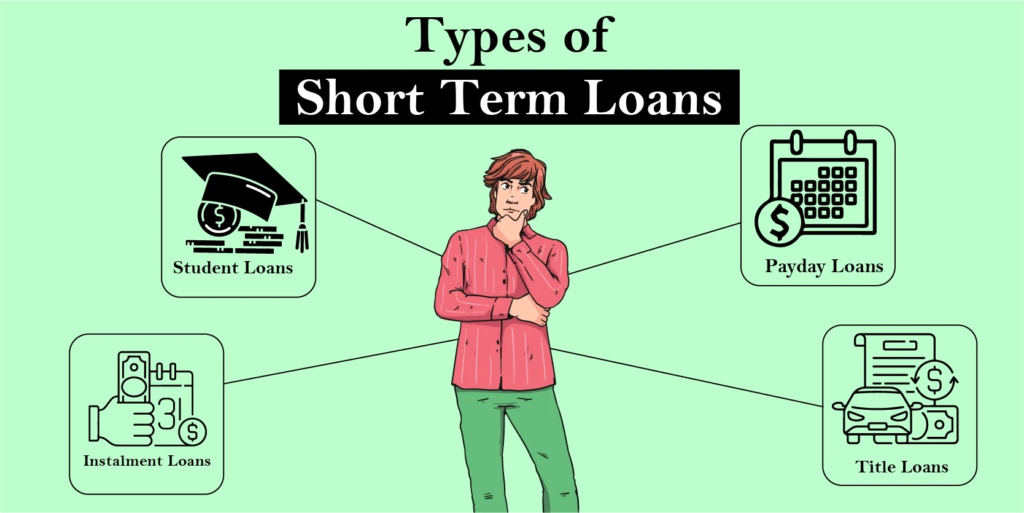

Types of Short Term Loans:

Several Short-term loans are available, the most unusual being payday, instalment, and identify loans. Each loan incorporates its terms and situations, which borrowers must understand before agreeing.

1. Payday Loans:

Short term payday loans are small, unsecured loans you usually pay returned once you receive your subsequent paycheque. They’re helpful for folks who want a small sum of money quickly.

2. Instalment Loans:

Instalment loans allow borrowers to pay off the loan in instalments instead of in one lump sum. These are often larger than payday loans and are repaid over the long run.

3. Student Loans:

Short term loans are Designed for academic prices, training, books, and residing prices. It offers numerous repayment options and usually has lower hobby prices than different short-term loans. Meanwhile, As of September 2023, the collective student mortgage debt in the United States amounts to $1.74 trillion.

4. Title Loans:

Title loans are secured loans where debtors use their car title as collateral. The lender holds onto the name until the loan is fully paid off. If a borrower can’t repay the loan, the lender can repossess and sell the vehicle to cover the mortgage amount.

5. Line of Credit:

A line of credit gives borrowers entry to a predetermined amount of finances to be drawn upon as needed. It’s a bendy alternative for coping with fluctuating charges, with interest best charged on the amount borrowed.

6. Cash Advances:

Cash advances allow borrowers to withdraw cash against their credit card’s available balance. While convenient, these short term online loans often come with high fees and interest rates, making them costly.

7. Short Term Business Loan:

A quick-term business mortgage gives brief funding solutions for fast monetary wishes. Typically repaid within 12 months, they’re perfect for addressing coin waft troubles or seizing possibilities. Faster approval processes and less documentation make them convenient, but borrowers should consider associated fees and interest rates carefully.

By diversifying your financial resources, you can better navigate unexpected expenses. Reputable short term loan lenders offer a range of solutions for individual needs. Explore their offerings for short term loan to find the best fit for your situation.

Understanding the Interest Rates and Fees:

When considering any form of short term loan, it’s crucial to comprehend the related interest fees and costs. Here’s an in-depth breakdown:

| Fee Type | Description |

| Annual Percentage Rate (APR): | Represents the overall value of borrowing, consisting of hobbies and fees, expressed as a yearly percentage. |

| Origination Fees: | Lenders frequently rate a charge based totally on a percentage of the whole loan quantity for processing a new loan utility. |

| Late Payment Fees: | Penalties are imposed when debtors fail to make timely payments. These expenses vary amongst creditors. |

| Prepayment Penalties: | Charges are incurred if borrowers pay off the mortgage earlier than the agreed-upon period, discouraging early repayment. |

| Additional Charges: | Includes software, file processing, or non-enough finances (NSF) charges, which could substantially impact the total reimbursement quantity. |

| Variable vs. Fixed Rates: | Differentiates between hobby rates that remain constant (fixed) during the mortgage term and people’s concern to change (variable) based on marketplace situations. |

Understanding these components is essential for borrowers to accurately assess the total cost of borrowing and make informed financial decisions.

Final Verdict:

Understanding the short term loan market necessitates careful consideration of the associated charges and interest rates. While these loans provide brief answers for instant economic wishes, they regularly include high charges that can cause financial stress. Grasping the terms and fees involved is crucial to avoid falling into a debt cycle. You must recollect their alternatives and discover monetary opportunities to achieve particular long-term economic well-being.

Similar Posts

Decoding The Price Structures: Adobe Workfront vs Trello Price Analysis

Is String Art Generator a Game-Changer or a Creative Crutch?

Leveraging Technology for Success in Australian Business