A Comprehensive Guide to Regular Military Compensation RMC Calculator

Regular Military Compensation (RMC) holds a pivotal role in military finances. The integration of technology, particularly the RMC Calculator, has significantly transformed the landscape of compensation calculations for military personnel.

This article takes an impartial approach to explore the features and benefits, shedding light on its intricacies. It also recognizes the challenges and limitations inherent in this tool, offering a comprehensive and balanced perspective on its functionality and impact.

Features of RMC Calculator:

1. Basic Pay Calculation:

It takes the guesswork out of basic pay calculations. Factoring in your rank, time in service, and special pay provides a precise and up-to-date figure for your essential pay component.

2. Allowances:

Gone are the days of juggling multiple allowances in your mind. This Calculator effortlessly considers housing allowance (BAH), subsistence allowance (BAS), and special pay, offering a comprehensive breakdown of your total compensation.

3. Tax Considerations:

Taxes can be a maze, but not with an RMC Calculator. These tools often incorporate tax-related information, shedding light on the tax implications of your compensation and helping you plan accordingly.

4. Retirement Benefits:

Are you looking to the future? This Calculator allows you to project your retirement benefits by inputting expected years of service and your desired retirement age, giving you a glimpse into your financial horizon.

How RMC Calculator Works?

Visit Website:

To understand how the calculator works. You have to visit its official website. The link is militarypay.defense.gov/calculators/rmc-calculator.

Input Parameters:

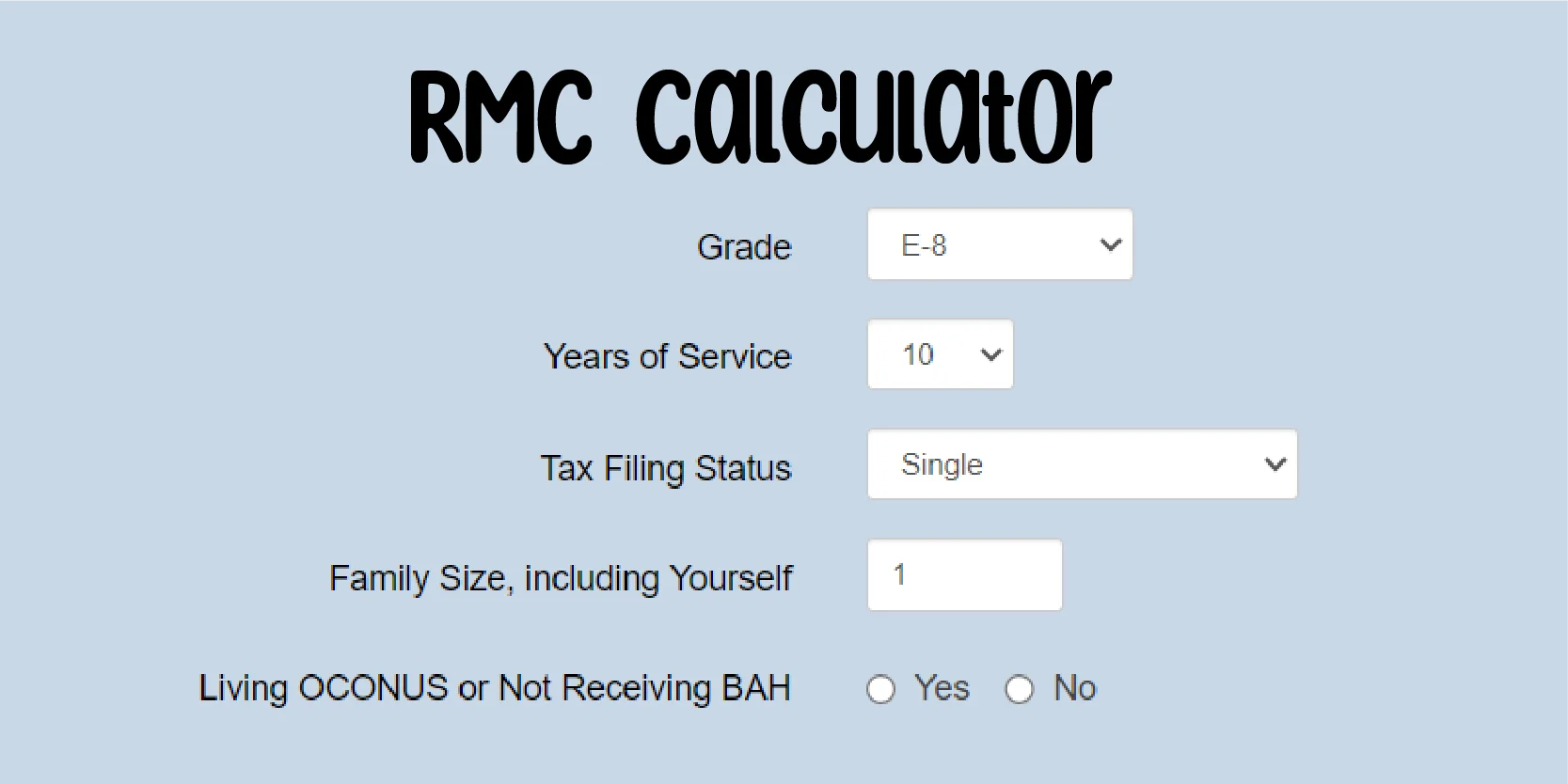

You have to enter the following details to find your answer.

- Grade

- Years of Service

- Tax Filing Status

- Family Size, including Yourself

- Living OCONUS or Not Receiving BAH

- Are you living in OCONUS?

Once you enter this information, hit enter, the calculator works according to the data.

Calculation Algorithms:

Behind the scenes, the calculator employs sophisticated algorithms based on current military pay scales, tax laws, and allowance rates to determine the various compensation components.

Output and Analysis:

The result? A detailed breakdown of your compensation, including basic pay, allowances, and deductions. This information isn’t just numbers. It’s a financial planning and analysis tool.

Meanwhile, it contains the following details.

- Annual Basic Pay

- Annual Basic Allowance for Housing

- Annual Basic Allowance for Subsistence

- Non-Taxable Allowances (BAH + BAS)

- Number of Exemptions for Previous Calendar Year

- Personal Exemption Amount

- Standard Deduction

- Total Deductions

- Taxable Income (Annual Basic Pay – Total Deductions)

- Tax Rate

- Gross-Up

- Tax Advantage

Benefits of RMC Calculator Military:

1. Transparency:

Transparency is the key to financial planning. This Calculator provides a clear and detailed breakdown of your compensation, fostering a better understanding of your financial situation.

2. Planning Tool:

The Calculator is a robust financial planning tool that empowers service members to make informed decisions. A clear financial picture is invaluable for career moves or retirement.

3. Time-Saving:

The days of manual calculations are Gone. This calculator streamlines the compensation assessment process, saving valuable time for service members who can now focus on other responsibilities.

Challenges of the RMC Calculator:

1. Complexity:

The military compensation landscape is intricate, and the Calculator faces the challenge of simplifying complex calculations. Navigating various allowances and special pay requires a tool that seamlessly handles the complexity.

2. Constant Updates:

With military pay scales, tax laws, and allowances constantly evolving, the Military Calculator needs frequent updates to provide accurate and relevant information. Staying on top of these changes is a perpetual challenge.

3. User Understanding:

Not everyone is a financial whiz. Some service members might need help grasping the Military Calculator’s intricacies, leading to potential misunderstandings and misinterpretations.

Limitations of the RMC Calculator:

1. Simplification:

While it simplifies the compensation process, this can lead to oversimplification in specific scenarios, potentially resulting in inaccuracies, especially when dealing with unique circumstances.

2. Personal Variables:

Life is dynamic, and personal circumstances change. Regular Military Compensation Calculators may not always accurately reflect individual variables like changes in marital status or dependents, impacting the precision of calculations.

Military Pay Calculator Monthly:

| Step | Description |

| Determine Pay Grade (Rank) | Identify the military personnel’s pay grade, typically based on their rank and length of service. |

| Access Pay Tables | Refer to the latest Department of Defence (DoD) military pay tables, which outline base pay rates for each pay grade. |

| Locate Basic Pay Rate | Find the basic pay rate corresponding to the specific pay grade and years of service. Pay rates are usually listed per month. |

| Calculate Monthly Basic Pay | Multiply the basic pay rate by 12 to calculate the annual basic pay. |

| Monthly Basic Pay = (Basic Pay Rate) x 12 | |

| Divide Annual Pay by 12 | Divide the yearly basic pay by 12 to obtain the monthly basic pay. |

| Monthly Basic Pay = (Annual Basic Pay) / 12 | |

| Official Tools or Consultation | For precise and comprehensive calculations, military members should utilize official tools provided by the Defense Finance and Accounting Service (DFAS) or seek assistance from finance or personnel offices. |

Military Pay Factors:

Military pay is influenced by pay grade/rank and years of service.

- In 2024, basic pay for enlisted service members ranges from $2,017.20 per month for an E-1 to $4,387.80 monthly for an E-6 with over a decade of service.

- Officers receive higher pay, starting with basic pay of $3,826.20 for new officers and $8,684.10 for O-4 officers with over 10 years of service.

- Basic pay constitutes the primary compensation for service members. Still, additional tax-free allowances and special pay based on duty station, qualifications, or military specialties are also included in their paychecks.

2024 Military Pay Calculator:

- The 2024 Military Pay Charts have been published, indicating a 5.2% increase in military pay compared to 2023.

- These pay charts apply to active-duty Navy, Marine Corps, Army, Air Force, Coast Guard, and Space Force members.

- It’s essential to recognize that the calculators provided by Military.com serve as initial tools for comprehending basic compensation.

- They are part of a collection of calculators available to service members serving actively or in an active status.

FAQs:

What is an RMC Calculator?

Regular Military Compensation Calculator simplifies military compensation calculations, providing a user-friendly way to understand pay, allowances, and deductions.

How does it differ from traditional calculations?

It leverages technology for faster and more automated calculations, making them more efficient than traditional methods.

What info do I need for the calculator?

Input your rank, time in service, dependents, and special pay into the calculator for an accurate breakdown.

Can RMC Calculator project retirement benefits?

Yes, this Calculator often allows projections for future retirement benefits based on expected years of service and retirement age.

How often should I update it?

Update your calculator when there are changes in military pay scales, tax laws, or allowances to ensure accuracy.

Does the RMC Calculator ensure privacy?

A reputable calculator prioritizes user privacy and security, but using a trusted and authorized calculator is crucial.

How does it benefit financial planning?

It offers transparency into compensation, empowering military personnel to make informed decisions about their careers and financial futures.

Is the RMC Calculator Free?

Yes, you can access it through its official website without any cost.

Conclusion

Regular Military Compensation RMC Calculator is a tool and a gateway to financial empowerment for those who serve. Although it provides numerous benefits, it also has some challenges, like regular updates, complexities, and user understanding.

While its transparency, planning capabilities, and time-saving features make it invaluable. As technology evolves, it ensures that military personnel get accurate and comprehensive compensation information.

Similar Posts

AI Agents for Business: How Companies Are Replacing Manual Work

Front Company Detection in 2025 | Avoid Fraud and Stay Compliant

China’s AI Cold War 2025 Arsenal From DeepSeek to ERNIE 4.5 Challenges Western Hegemony