ERC Loan Advance: A Guide to Financial Empowerment

| Unlock Financial Ease with ERC Advances: Your Bridge to Stability! |

The Employee Retention Credit (ERC) program has emerged as a vital financial lifeline for individuals, especially those facing challenges. ERC loan advance is a cornerstone of this program. It offers crucial support during uncertain economic periods.

Understanding ERC Advance Payment Loan:

These are tailored to ease the financial burdens of individuals experiencing difficulties managing their rental obligations. These advances serve as a temporary solution, bridging the gap during unforeseen circumstances such as job loss or medical emergencies.

ERC Advance Loan Application Process:

Experience the ease of applying for ERC loan advances through its user-friendly online form, or opt for a hassle-free application by calling us for a FREE consultation. Our process is designed for simplicity, allowing applicants to initiate their applications in minutes.

1. Eligibility Criteria:

You must know its eligibility criteria before applying for an ERC advance loan. Typically, applicants must demonstrate a genuine need for financial assistance, supported by documentation such as proof of income, lease agreements, and evidence of financial hardship.

2. Required Documentation:

| Gathering the necessary documents is critical in ensuring a seamless application process. |

The ERC expert team will guide you through the documentation required for your application. This personalized assistance ensures that you have all the essential documents. It helps you to streamline the process and minimize any potential delays.

Usually, documents are recent pay stubs, tax returns, and letters explaining their financial hardship.

3. Online Application:

ERC Affiliate Program usually offers online application platforms for convenience. Explore the designated website or portal to complete the necessary forms, providing accurate information about your financial situation.

4. Professional Application Completion:

The ERC’s experienced team will accurately and efficiently complete the application on your behalf. It reduces the burden on applicants and increases the chances of a smooth approval.

5. Application Review:

The submitted applications undergo a thorough review process. It involves the verification of documents and an assessment of the applicant’s financial status. Remember that a transparent and timely review process is crucial for those in urgent need.

6. Rapid Funding:

Instead of enduring a lengthy waiting period of 6-12 months, ERC streamlines the process and ensures that approved applicants receive funds in just 1-2 weeks.

This expedited funding can make a significant difference, providing timely assistance during financial challenges.

7. ERC loan advance due date:

You have three years from the date of filing the original return. Also, you have two years from the date of any tax liability associated with that return to claim the ERC.

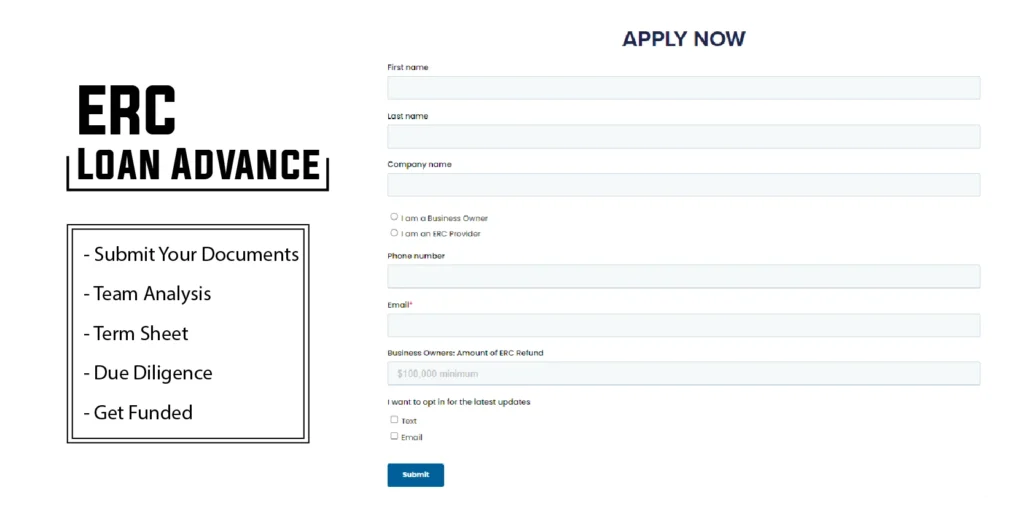

ERC Advance Refund Process:

ERC optimized the ERC advance refund process to simplify your experience further.

- Submit Your Documents

- Team Analysis

- Term Sheet

- Due Diligence

- Get Funded

1. Submit Your Documents:

First, Forward your ERC claim documents. It initiates the refund process.

2. Team Analysis:

The ERC program team conducts a thorough analysis of your claim. It identifies the potential buyer for you to ensure maximum value.

3. Term Sheet:

Once the analysis is complete, you’ll receive a comprehensive term sheet. The sheet contains all the details regarding the transaction for your clarity and understanding.

4. Due Diligence:

Before finalizing the transaction, the ERC Program conducts rigorous due diligence. It verifies all information and carries out necessary checks for a secure process.

5. Get Funded:

After successful completion of due diligence, your payment is processed. Then you’re promptly funded. The goal is to expedite the refund process, promptly providing financial relief.

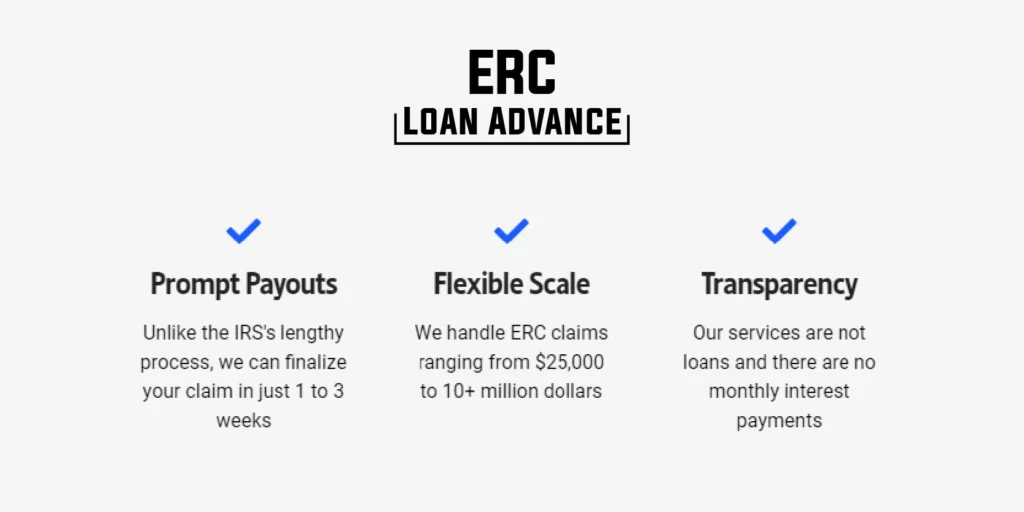

ERC Loan Advance Payouts:

ERC’s commitment is to provide financial well-being through prompt payouts and flexibility in scale. This quick process makes ERC different from the IRS’s lengthy processes.

1. Prompt Payouts:

Unlike the IRS’s lengthy process, the ERC Affiliate Program finalizes your claim ASAP. It gives you an Experience of quicker resolutions and ensures you receive the funds you need without unnecessary delays.

2. Flexible Scale:

The services cater to ERC claims ranging from $25,000 to 10+ million dollars. Whether your financial needs are modest or substantial, Its flexible scale accommodates a wide range of claim amounts, ensuring comprehensive support.

3. Transparency:

Along with payouts and a flexible scale, the ERC Affiliate Program prioritizes service transparency. Unlike other loans, These are not involved in monthly interest payments. It provides clear and straightforward financial assistance.

ERC Loan Advance and Payment Schedule:

The journey through it continues with a focus on the disbursement of funds and establishing a manageable repayment plan.

1. Loan Amount Determination:

It is not one-size-fits-all. However, they are tailored to individual business circumstances. Since it’s a relief fund to compensate for COVID-19 damages, you can easily avail yourself of the amount you have lost.

2. Payment Disbursement:

Funds are typically disbursed directly to the landlord or property management company upon approval.

It ensures that the financial assistance serves its intended purpose, covering rental expenses and preventing housing instability.

3. Repayment Plans:

While it provides immediate relief, repayment plans are designed in a manageable way. Also, it allows individuals to gradually repay the borrowed funds without exacerbating financial stress.

FAQs:

How long does the ERC loan advance application process take?

Completing the online form takes just a few minutes, and the expert team works diligently to review and process applications promptly.

What documents are required for the ERC loan advance application?

All necessary documents are required, such as proof of income, lease agreements, and evidence of financial hardship. Meanwhile, the team guides you to ensure you have all the essential documents.

Can I apply for an ERC loan advance for any amount?

Absolutely. The flexible scale accommodates ERC claims ranging from $25,000 to 10+ million dollars, catering to various financial needs. You need to be aware of its eligibility criteria.

How quickly can I receive funds after approval?

Unlike the IRS’s lengthy process, this platform strives to finalize your claim in 1 to 3 weeks. Once approved, funds are promptly processed, providing swift financial assistance.

Final Verdict:

ERC loan advance is a beacon of support for individuals. It makes your financially challenging time bearable and brings ease. As ERC programs evolve, staying informed is paramount for individuals to gain maximum benefits from loan advances and achieve financial stability during uncertain times.

Similar Posts

Redbooth: A Review of its Role in Modern Project Management Software

Web Development Agency: Building the Digital Future

Century Ethos Review