How Can the Velocity Banking Calculator Transform Your Financial Strategy?

| The Velocity Banking Calculator offers a neutral and practical approach to financial planning, assisting users in optimizing their debt repayment strategies. |

Navigating a personal budget can be like locating your manner through a maze. With money owed to manipulate and monetary dreams to reap, it’s easy to sense beaten. But worry now not because the Velocity Banking Calculator is here to fill the gap.

It’s not just any tool but a solution designed to simplify the complexities of managing your cash. Of all Americans, 74% maintain a monthly budget, yet 84% have surpassed their budget at least once. With its user-friendly capabilities, it offers the guidance you need to streamline your budget, boost debt compensation, and pass in the direction of your financial goals.

What is Velocity Banking?

It is a financial strategy that uses a line of credit score, domestic fairness line of credit (HELOC), or a personal line of credit score to repay money owed extra quickly.

The strategy focuses on leveraging available funds, typically by depositing income directly into the line of credit. It reduces the exceptional balance and minimizes interest payments. Individuals can accelerate debt reimbursement by strategically allocating price ranges, making additional payments toward money owed, and saving on interest.

What is Velocity Banking Calculator?

It is a financial device designed to assist people in managing their debts more efficaciously.

It enables customers to optimize their debt repayment strategies through leveraging concepts much like speed banking, which involves the usage of a line of credit to accelerate debt payoff.

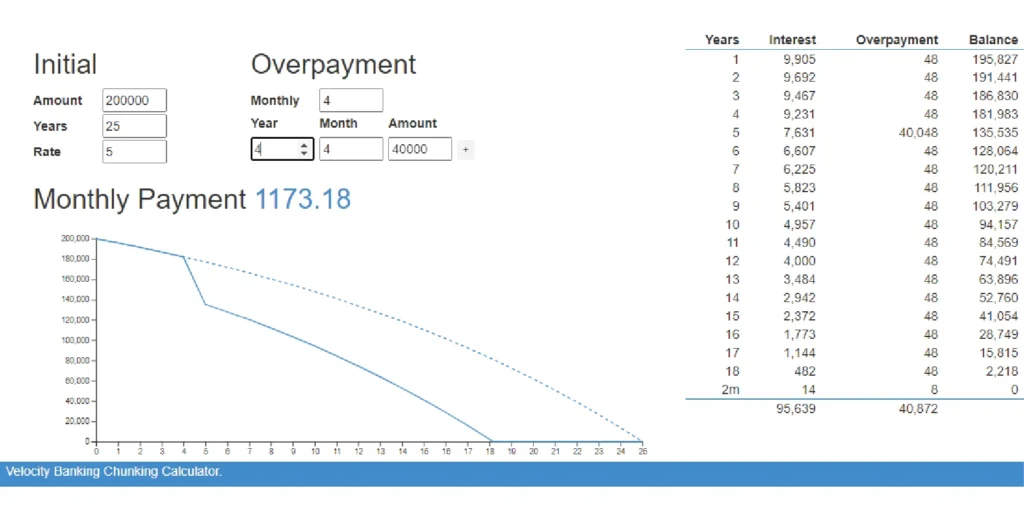

The calculator could allow users to enter details about their debts, such as balances, hobby costs, and month-to-month bills. It then gives personalized reimbursement plans and insights to help them obtain their monetary desires quickly.

Velocity Banking Calculator Features:

Personalized Debt Repayment Plans:

The users enter their debts, hobby fees, and monthly bills to create personalized debt reduction strategies.

Visualize Your Progress:

Users can visualize the effect of creating additional bills toward their debts, including potential savings in hobbies and time to debt freedom.

Compare Strategies:

The calculator permits users to compare the effectiveness of different debt repayment methods, along with the debt avalanche and debt snowball, to determine the greenest technique for their economic scenario.

How Do You Use a Free?

Visit the Velocity Banking Calculator website:

Input Your Debt Details:

Enter information about your debts into the designated fields, including balances, interest rates, and minimum monthly payments.

Explore Repayment Strategies:

Experiment with different repayment scenarios by adjusting the extra payment amounts and repayment methods to see how they impact your payoff timeline and interest savings.

Review Your Plan:

Once you’ve observed a repayment plan that fits your desires, evaluate the info and ensure it aligns with your financial scenario and goals.

Implement Your Plan:

Take motion for your debt reimbursement plan by making additional payments toward your debts every month, following the approach mentioned by the calculator.

Monitor Your Progress:

Regularly track your debt balances and repayment progress to stay motivated and adjust your plan as needed.

Benefits:

Faster Debt Payoff:

In the United States, 82% of business failures can be attributed to cash flow issues.

Using pace banking concepts, you can say goodbye to debt sooner and preserve extra cash through slashing interest payments.

Better Financial Awareness:

Gain insights into your debt scenario, balances, interest fees, and reimbursement timelines, helping you make knowledgeable economic decisions.

Stay Motivated:

Watching your money owed cut back, and your savings develop can motivate you to stick to your repayment plan and reap your economic desires.

Is Velocity Banking Your Best Debt Payoff Strategy?

With home and hobby prices growing, residence owners are exploring options for conventional coins-out refinancing, turning to Home Equity Lines of Credit (HELOCs) for debt consolidation.

HELOCs are typically used to consolidate diverse varieties of debt, from credit playing cards to clinical charges. However, speed banking has gained recognition as a powerful debt pay-down method. Claiming to help house owners unexpectedly reduce debt, along with mortgages, using a HELOC pace banking calculator, a few have even managed to pay off a 30-year mortgage in less than seven years.

Can Velocity Banking help you pay off your mortgage faster?

While it is not appropriate for everyone, it has been established as a sport-changer for a few. This manual will elucidate how it operates and who benefits the most from its utility.

It is a reasonable tool for those who meet specific criteria. Make yourself an expert in how it works and how to assess financial scenarios. After that, You can decide whether it is the right strategy to help you reap your debt payoff dreams.

Velocity Banking Calculator Excel:

Crafting your spreadsheet in Excel empowers efficient financial management. Break down expenses, input interest rates, and balances to optimize debt payoff effortlessly. With strategic paycheck allocation and cash flow leverage, achieve consistent progress. Calculate precise payoff timelines for enhanced financial strategy.

HELOC Velocity Banking Calculator Limitations:

Stable Income Required:

The calculator assumes a steady earnings circulate, which may not mirror actual-existence fluctuations in earnings.

Emergency Preparedness:

It makes a specialty of competitive debt reimbursement, potentially leaving users liable to unforeseen monetary emergencies.

Requires Discipline:

Implementing pace banking requires subject and dedication to paste to the repayment plan, which can be challenging for some people.

FAQs:

Can velocity banking help with all kinds of debts?

Is velocity banking the same as debt consolidation?

How do I know if Velocity Banking is right for me?

What is a Velocity Banking Strategy Calculator?

Final Verdict:

The Velocity Banking Calculator is a guiding light in the quest for financial freedom. It illuminates the path toward accelerated debt payoff and a brighter financial future. By harnessing the power of this tool, individuals can break free from debt and embark on a journey toward financial independence.

Similar Posts

Understanding Geotester Login

ACCC Chairwoman Gina Cass-Gottlieb Sets $35 Million Stance as New Merger Regulations Approach

Simplifying High-Risk Merchant Accounts for Online Businesses with HighRiskPay