Top 5 Tech Giants with Sky-High Potential in the Short Term

Technology advanced significantly in 2023, primarily due to a push towards artificial intelligence (AI), incredibly generative AI. In 2024, Wall Street investing strategies will continue to be shaped by this tendency.

Thus far this year, the S&P 500 broad-market index’s 11 sectors have seen increases of 7.7% and 9.5%, respectively, in the tech giants sector and its closely related area, communication services.

The benchmark S&P 500 has increased by 7.4% so far this year. The tech-focused Nasdaq Composite has also increased by 8.9% over the same time frame.

Grand View Research projects that by 2030, the amount spent on AI services, software, and hardware will have increased by an astounding 820%, from $197 billion in 2023 to $1.8 trillion.

The Nasdaq trailed at first but gained ground on the last day of February, closing the month with a 6.1% gain.

This irrepressible Nasdaq rebound starkly contrasts its less-than-stellar performance in 2022, when growth equities were negatively impacted by rising interest rates, which hurt tech firms.

But since then, significant tech companies have made a strong comeback, helping the Nasdaq overcome its earlier difficulties.

The latest upswing is driven by the ongoing excitement surrounding artificial intelligence (AI), which has supported significant technology stocks and helped the market as a whole.

Top 5 tech giants Set to Soar Over the Next Decade

Within the quickly changing technology sector, a few leading organizations are expected to experience substantial growth in the coming ten years.

These technological behemoths are well-positioned for long-term success because of their cutting-edge products, strong balance sheets, and inspiring leadership.

The top five tech giant once known as multitech companies expected to grow significantly over the next ten years are listed below.

1- Meta Platforms Inc.

All regions of Meta Platforms Inc., formerly Facebook, are seeing steady increases in the number of users, with the Asia Pacific region leading the way.

Growing user involvement on Facebook, Instagram, WhatsApp, Messenger, and other platforms has been a primary driver of this expansion.

By suggesting Reels content, META uses artificial intelligence to improve user experience and drive more traffic to Facebook and Instagram.

META’s growth trajectory is anticipated to be aided by its innovative product portfolio, which includes Quest 3, a mixed reality device, Threads, Reels, Llama 2, and the intelligent Meta ray-ban glass.

With their increasing ubiquity, reels do exceptionally well on Facebook and Instagram. Users reshared Reels content 3.5 billion times daily in the fourth quarter.

Meta Platforms projects revenue and earnings growth rates of 17.7% and 34.1% for the current year. The current-year earnings Zacks Consensus Estimate has increased by 0.6% during the previous 30 days. In addition, META’s stock price has risen by 42.9% this year.

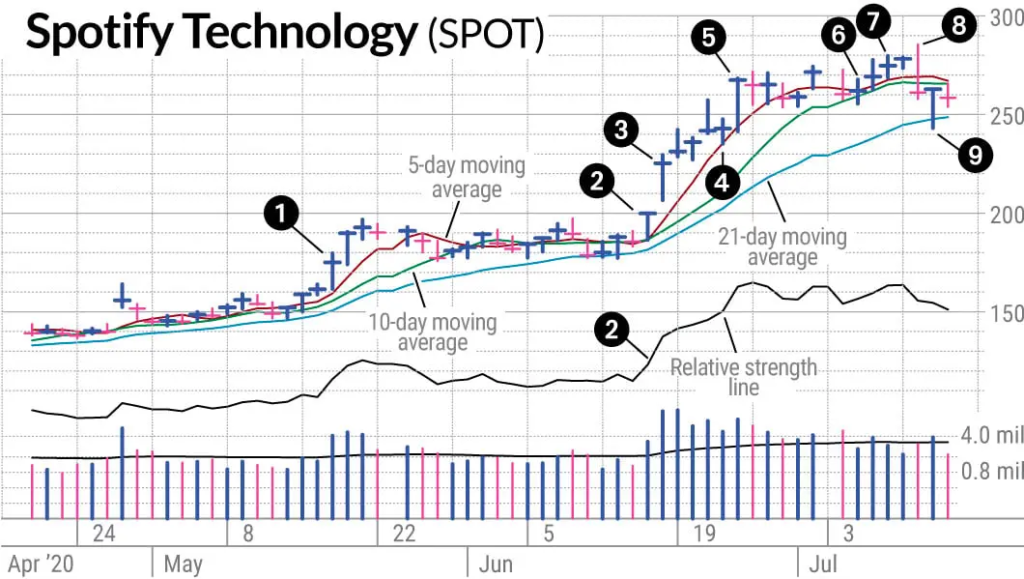

2- Spotify Technology

Spotify Technology is the most famous music streaming platform worldwide. Considering the company’s competitors, that is a significant accomplishment. Spotify faces competition from three of the biggest technological names: Apple, Amazon, and Alphabet.

They may run their music streaming businesses at a loss while attracting enough subscribers to push pure-play rivals like Spotify out of business thanks to their substantial resources and established ecosystems.

However, that has yet to occur. Regarding subscriptions, Spotify has a 31.7% market share as of the third quarter, nearly equal to the combined shares of Apple, Amazon, and Alphabet. Spotify has 602 million MAUs in the fourth quarter, up 23% from the previous year.

After the quarter, it had 236 million premium members, a 15% increase from the prior year. Spotify reported 3.7 billion euros in revenue, 16% more than the previous year.

Although it has yet to be consistently profitable, Spotify has improved over time. As an illustration, it reduced the operational deficit from 231 million euros in Q4 2022 to 75 million euros this time.

3- Microsoft Corporation

One of the most significant worldwide providers of broad-based technology is Microsoft Corporation. Microsoft leads the PC software industry With over 73% of the market share for desktop operating systems.

One of the world’s most widely used productivity software suites is Microsoft 365, developed by Microsoft Corporation. Microsoft is another well-known public cloud provider offering many platform-as-a-service and infrastructure-as-a-service options at scale.

Microsoft Corporation anticipates an 18.6% earnings increase in the current fiscal year. Over the previous 60 days, the Zacks Consensus Estimate for current-year earnings has increased by 4.5%.

4- Super Micro Computer Inc.

Based on the x86 architecture, Super Micro Computer Inc. (SMCI) creates, develops, produces, and sells energy-efficient server solutions optimized for various applications. The company offers a range of blade and rack mount server systems and individual parts.

Leading server boards, chassis, and server systems in the market are delivered by SMCI through strict quality control procedures and excellent product design.

A variety of scenarios, such as data center deployments, high-performance computing, sophisticated workstations, storage networks, and standalone server configurations, can benefit from these Server Building Block Solutions.

A lesser percentage of SMCI’s server systems and components are sold to original equipment manufacturers; most are distributed through partners like system integrators and value-added resellers.

5- Amazon Stock

Amazon’s profits also addressed concerns about its profitable cloud computing business.

Amazon Web Services’s sales growth of 13% yearly is an improvement over the division’s third-quarter growth rate of 12%. Analysts have been watching for signs that suggest AWS’s sales would pick up steam after a halt in growth last year.

With the largest market share among cloud providers, AWS provides millions of organizations with storage and processing capability. Two-thirds of Amazon’s projected $37 billion operational income in 2023 came from it.

But since early last year, investors have been cautious about the company. Companies have reduced some of their computer expenses, which has resulted in a slowdown in revenue growth.

Key Takeaways for Investors and Industry Observers

To be competitive and ahead of the curve in the tech industry, one must constantly watch and adapt. Japanese tech giant businesses must continuously evaluate market patterns, technological breakthroughs, and rival tactics in a sector marked by swift innovation and changing customer needs.

Tech businesses can anticipate changes, capture opportunities, and manage risks by regularly assessing these elements and making necessary adjustments to their products, services, and strategy.

In addition to ensuring relevance in the rapidly evolving tech sector, this proactive approach promotes adaptability and resilience in uncertainty. Ultimately, one must embrace constant observation and adjustment to succeed and grow in the fast-paced tech industry.

FAQs

Q1: How do you determine a tech giant’s short-term growth potential?

Answer: Product pipeline, market trends, and financial performance are crucial in assessing short-term growth prospects.

Q2: What risks should investors consider when investing in tech giants?

Answer: Regulatory challenges, competition, and macroeconomic factors can impact the growth trajectory of tech giants.

Q3: Why is diversification important for tech giants like Apple and Amazon?

Answer: Diversification helps mitigate risks associated with overreliance on a single product or market segment.

Q4: What role do emerging technologies like AI and blockchain play in the growth of tech giants?

Answer: Adopting emerging technologies enables tech giants to innovate, improve efficiency, and create new revenue streams.

Q5: How do geopolitical tensions affect the short-term prospects of tech giants?

Answer: Geopolitical tensions can disrupt supply chains, regulatory environments, and market access, impacting tech giants’ growth trajectories.

Similar Posts

Smart Square Wellstar Review – A Healthcare Solution

Unveiling the 5 powerful benefits of Google review links

TikTok Music Clash with Universal Music Group Forces Removal of Popular Songs