Oportun App Review as a Financial Solution – Manage your Savings and Expenses

| Through your savings, Oportun made your dreams possible. |

Do you want to keep your expenses according to your budget? If yes, then Oportun is for you. It helps you save your money and manage your expenses simultaneously. Also, you don’t need to be nervous and conscious about calculations at each step.

Oportun was established in 2013 by Ethan Bloch. Meanwhile, the Oportun trial is free but costs a little monthly to provide services around savings and spending. However, there is no charge or cost to oportun app download.

What is Oportun App?

Oportun is one of the best money savings apps that keeps your savings aligned and manages all your finances.

Surprisingly, this saving app, Oportun, analyses your spending habits and informs you how much you can save daily.

Since the oportun mobile app does all the calculations, it saves both your time and energy. Also, all processes proceed through algorithms and software, so there are fewer chances of errors.

Oportun Features:

What more do you want when Money stays safe and secure? It offers many features, but two prominent features are discussed below.

Security:

Security is the top priority in all industries. Nobody can keep their Money in an insecure place. Therefore, Oportun ensures strong security to keep your money safe and secure.

Since you deposit your Money in FDIC-insured accounts, it ensures military-level 256-bit encryption security and enables face recognition security. Therefore, the Oportun provides you with a guarantee and security about your spending and savings.

Retirement Package:

As of April 2023, the total personal savings in the United States reached $802.1 billion. Like everyone, you must think about how you will spend your life after retirement. Oportun knows your worries and thoughts. It offers an Oportun retirement package to make your post-retired life super easy.

Meanwhile, apps like oportun has different individual retirement accounts IRA for investments. Therefore, you can join an IRA account for your retirement savings and some risk-taking packages based on your financial status. Surprisingly, this retirement investment option is also available on a monthly subscription.

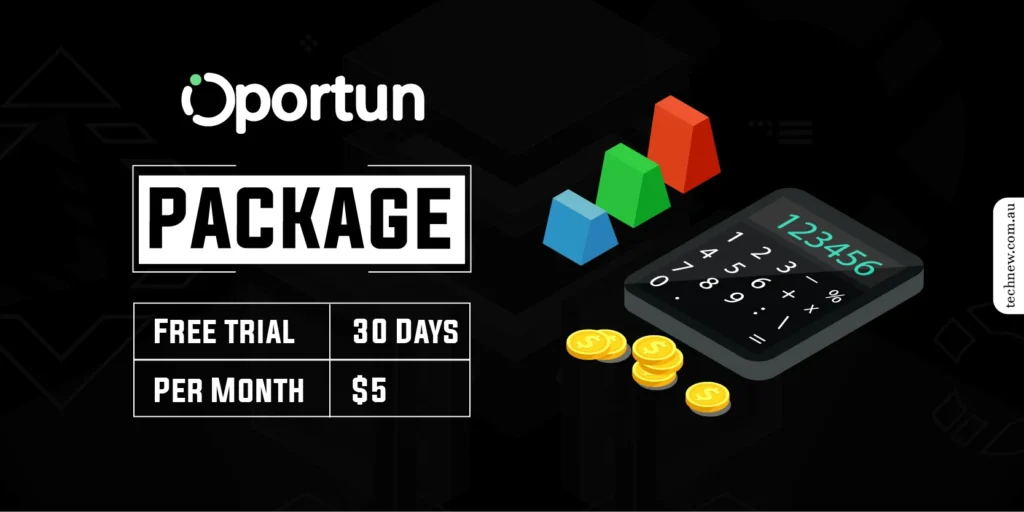

Oportun Cost:

After knowing the Oportun benefits and features, you must think it would be an expensive Financial software. Surprisingly, it’s not as expensive as other financial apps.

Since it is a saving application for individuals, it charges a very minimal amount from you.

Oportun charges zero while downloading. Also, it will not charge you for the first 30 days. After one month, once you are satisfied with its services, it charges you only $5 monthly.

How to Use Oportun?

Now, the question is, how can you install the Oportun? No worries, You can download the app easily. Here are the simplest steps you need to follow.

- First, Download Oportun through the Play Store.

- After that, sign up through your account.

- Once you sign up, you will see the guide on how to save money through Oportun.

- In the initial phase, go for a free trial and purchase subscriptions.

After the fourth step, the initial process is done.

How Money Saving App Oportun Works?

After signing up on Oportun, you must enter your financial status for further calculations. At this moment, the actual process will begin.

Now, the financial solution Oportun starts analyzing your spending and payments against your income. Then, the actual step, “How to save Money,” Oportun made.

It will automatically transfer your unnoticed amount, whether big or tiny, to the Oportun account daily.

Meanwhile, based on daily readings, Oportun sets limits regarding savings depending on your spending structure.

Also, to ensure a balanced saving structure, the Oportun savings algorithm focuses on the following four primary factors.

- Your bank account balance (Balance Amount)

- Your upcoming bills (Spending / Payments)

- Your upcoming income (Receiving)

- Your recent spending (Daily Expenses)

Eventually, it reads these factors, and then, based on your spending and expenses, it saves some amount and transfers to your Oportun savings account.

Benefits of Oportun as a Money-Saving App:

Undoubtedly, the Oportun application is the best savings and expense management app. It provides many benefits for individuals, and some key advantages are discussed below.

| Save Smarter, Spend Wiser |

- Surprisingly, the Oportun Financing app does not transfer money directly to your bank account. But first, understand your savings and spending, then decide the saving amount. The saving amount is based on your cash inflows and cash inflows.

- You are not supposed to think about how much money you should save for today. It will automatically proceed through the app.

- You don’t need to calculate the available balance after every withdrawal. You can withdraw any amount at any time. The saving algorithm will work by itself.

- It does not apply any limit on withdrawal. You are free to withdraw your amount at any time.

- In this inflationary world, it takes time to achieve financial goals. Now, the Oportun app manages your finances. It continuously shows you how much time you need to accomplish your financial task. You can set unlimited financial goals for your accounts based on your daily spending, and then the Oportun strategy helps you achieve them in a specified period.

- You can assign sections for your savings like Rainy Day fund, student loan goal, Oportun credit card goal, etc. It allows you to make it and save your money accordingly.

Oportun Login App:

Although Oportun works perfectly in its countries of origin, some locations are curious as to why Oportun is not working. Such situations could have happened.

Sometimes, the app developer wants to restrict some locations and areas to check the status and results of applications in certain areas. Also, sometimes, the Organizer wants to design Money saving apps for specific users. You might face Error 16 when logging in to the Oportun page.

The question would arise: Did this only happen with the Oportun application? The answer is No. Many other apps are restricted to specific locations. Like Smart Square HMH, a scheduling app to maintain your daily activities. HMH Smart Square is also limited in particular areas due to security precautions.

Meanwhile, you can use a VPN to access the Oportun in a restricted location. Through a VPN, you can easily access the official page.

Final Verdict:

Oportun works to Save smartly and spend wisely. Therefore, it helps to keep your Money secure through small investments and expenses under your control. It allows you to make unlimited saving sections to make your dreams real.

Lastly, it’s a user-friendly app you can access through your laptop and phone, whether Apple or Android.

Similar Posts

Is Cycling FTP Calculator Worth the Hype? A Detailed Review and Analysis

Unbiased Review of Baldurs Gate 3 Build Calculator

Top 9 Latest Technology Innovations in the Automobile Industry