China’s AI Cold War 2025 Arsenal From DeepSeek to ERNIE 4.5 Challenges Western Hegemony

The new Cold War isn’t about missiles, it’s about machine intelligence. In 2025, China’s AI cold war is accelerating at breathtaking speed. While Western nations debate AI ethics and governance, China has launched a multi-front technological offensive, covering large language models (LLMs), multimodal tools, autonomous agents, and video-generation systems.

This isn’t imitation anymore. It’s innovation, speed, and scale, and it’s forcing Silicon Valley to rethink what leadership really means.

“AI leadership will define superpowers more than nuclear arms ever did.” Elon Musk, CEO, xA

DeepSeek: The Disruptor that Changed the Game

Developer: DeepSeek (Hangzhou, China)

Model: DeepSeek V3.1 / V3.2-Exp

Type: Open-weight Large Language Model

Key Strength: Cost-efficiency and hybrid inference

DeepSeek stunned the global AI community when it revealed its model could rival GPT-4-tier performance at one-tenth the cost. Built partly on domestic chips (Huawei Ascend), DeepSeek bypassed U.S. export restrictions and ignited China’s “open-weight revolution.”

However, researchers at Oxford and Stanford caution that DeepSeek’s safety vulnerabilities and alignment weaknesses could make it risky for Western enterprises to adopt.

ERNIE 4.5: Baidu’s Strategic Masterstroke

Developer: Baidu

Model: ERNIE 4.5 / X1 Turbo

Focus: Multimodal AI (Text + Vision)

Baidu’s ERNIE 4.5 marks the company’s biggest leap since GPT-4o. Robin Li, Baidu’s CEO, calls it “our most powerful, most balanced model yet.”

The model blends text reasoning, visual understanding, and multilingual processing. What’s more, Baidu announced it will open-source ERNIE 4.5 by mid-2025, a move that aligns with Beijing’s new “open-innovation” directive.

“China’s AI race will be won by those who scale safely, not just cheaply.” Robin Li, CEO, Baidu (Forbes Asia Interview, 2025)

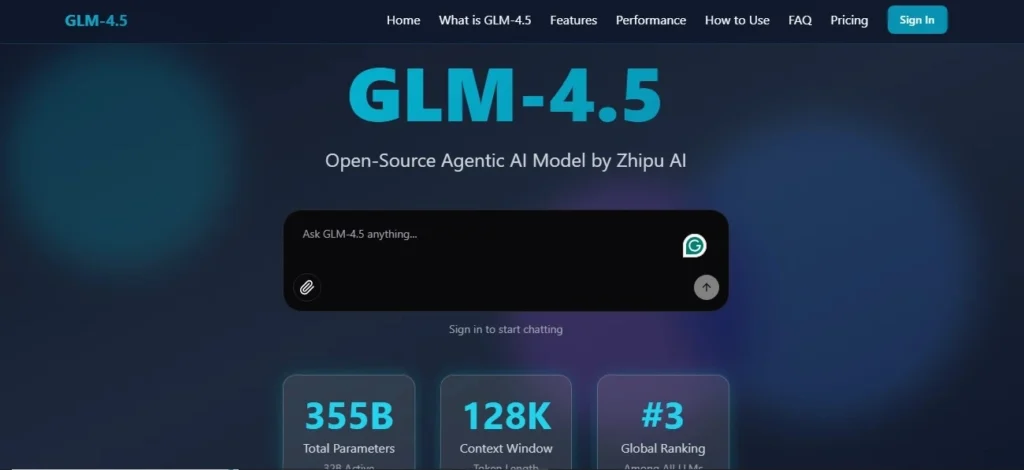

Qwen 3 and GLM-4.5: The Cloud and the Price War

Qwen 3 (Alibaba) – A multilingual, enterprise-focused model embedded in Alibaba Cloud. It powers e-commerce search, customer service, and logistics optimization across China and Southeast Asia.

GLM-4.5 (Zhipu AI) – A low-cost LLM offering API prices up to 90% cheaper than GPT-4-level services. It’s the “AI for everyone” model, democratizing access for SMEs.

According to Kr-Asia, Zhipu’s model lowered per-token pricing to under $0.0003, unlocking mass adoption across Asia and Africa.

“China has found the holy grail of AI adoption, affordability at scale.”

Kai-Fu Lee, CEO, Sinovation Ventures (Bloomberg Interview, 2025)

Seedream 4.0, OmniHuman, and Kling AI: China’s Creative Frontline

Developers: ByteDance & Kuaishou

Models: Seedream 4.0, OmniHuman, Kling 2.5 Turbo

Focus: Video & image generation

While Western media marvels at OpenAI’s Sora, Chinese developers are quietly shipping consumer-ready video models with comparable quality.

- Seedream 4.0 – Produces photorealistic stills rivaling Midjourney v6.

- OmniHuman – Generates ultra-lifelike digital avatars for content creators.

- Kling AI – Generates 60-second 4K videos from text prompts, optimized for TikTok-style content.

Kuaishou’s 2025 release notes mention Kling 2.5 Turbo can render at 10× speed of Runway ML while retaining cinematic realism. (TechNode)

“The future of creativity will be synthesized in China first.”

Prof. Fei-Fei Li, Stanford HAI, 2025 panel discussion

Manus AI: The Rise of Autonomous Agents

Developer: Manus Tech (Beijing)

Type: Agentic Intelligence Platform

Capability: Autonomous reasoning, multi-step execution

Manus AI represents China’s push into the agentic era of AI that can not only respond, but act.

The company promotes its models as “autonomous action engines,” similar to OpenAI’s Operator GPTs concept, allowing enterprises to delegate workflows entirely to software agents.

According to News 2025, Chinese logistics and fintech firms are piloting Manus agents to handle end-to-end operations without human supervision.

“By 2026, the most valuable AI will be the one that thinks and acts.”

Andrew Ng, Landing AI founder

Comparative Snapshot: China vs West (2025)

| Category | China (2025) | West (2025) |

| Innovation Speed | ✅ Faster iteration cycles | ⚖️ Slower, more regulated |

| Cost & Access | ✅ Lowest global pricing | ❌ Premium, closed APIs |

| Video & Creative AI | ✅ Ahead (Kling / Seedream) | ⚖️ Catching up (Sora / Runway) |

| Enterprise Integration | ⚖️ Growing via Alibaba / Baidu Cloud | ✅ Deep (Azure, Google Cloud) |

| Trust & Safety | ⚠️ Concerns over data/bias | ✅ Stronger governance |

| Hardware Autonomy | ⚙️ Rising (Huawei Ascend) | ✅ NVIDIA / AMD advantage |

Strategic Analysis: What It Means for 2026

China’s AI ecosystem now resembles a multi-domain military doctrine:

- DeepSeek for offense (innovation & cost)

- ERNIE 4.5 for defense & institutional trust

- GLM / Qwen for supply chain coverage

- Kling / Seedream for media dominance

- Manus AI for agentic command

If 2023–24 was the LLM arms race, 2025–26 is the automation arms race, one that China is well-positioned to lead.

However, challenges remain: global trust, ethical transparency, and geopolitical alignment could still determine who truly wins the AI Cold War.

“The race is not for the smartest model, it’s for the most trusted ecosystem.”

Dr. Sam Altman, OpenAI CEO (World Economic Forum, 2025)

Also Read: ChatGPT-5 in 2025: Features, Updates, and Everything You Need to Know

Conclusion: The Algorithmic Divide

The line dividing East and West is no longer geographical; it’s algorithmic.

While OpenAI, Google, and Anthropic dominate Western enterprise ecosystems, Chinese innovators like DeepSeek, Baidu, and ByteDance are redefining AI accessibility, speed, and scale. China may not “win” the AI race outright in 2025, but it has shifted the balance of power.

The new superpower isn’t a nation, it’s whoever controls intelligence itself.

Similar Posts

Unbiased Review of Baldurs Gate 3 Build Calculator

How Kling AI Avatar 2.0, AI Face Swap, and Lip Sync Are Quietly Reshaping Video Production

Unblocked Games 911 Features and Powerful Analysis