Australia’s Unemployment Rate: Job Market Remains Extremely Tight

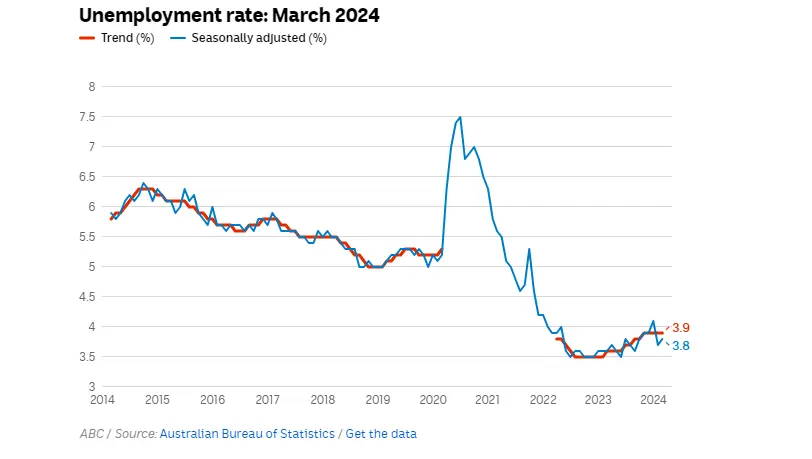

In March, Australia’s unemployment rate rose slightly to 3.8% after a decrease of 7,000 in employment and a rise of 21,000 in unemployment.

This small reduction in employment caused the unemployment rate to increase by 0.1 percentage points from 3.7% in February.

Nonetheless, a more stable indicator of unemployment provides a clearer view of the labor market’s current state.

Data indicates that the ‘trend’ unemployment rate has consistently held at 3.9% for the past five months, demonstrating some inherent economic strength.

“Even with a slight decline in employment, Australia’s unemployment rate remains extremely tight,” remarked Callam Pickering, APAC senior economist at the global job site Indeed.

On Thursday, alongside the unveiling of the March unemployment figures, the Reserve Bank released the newest issue of its quarterly Bulletin.

This edition included a dedicated section on how the RBA evaluates “full employment.”

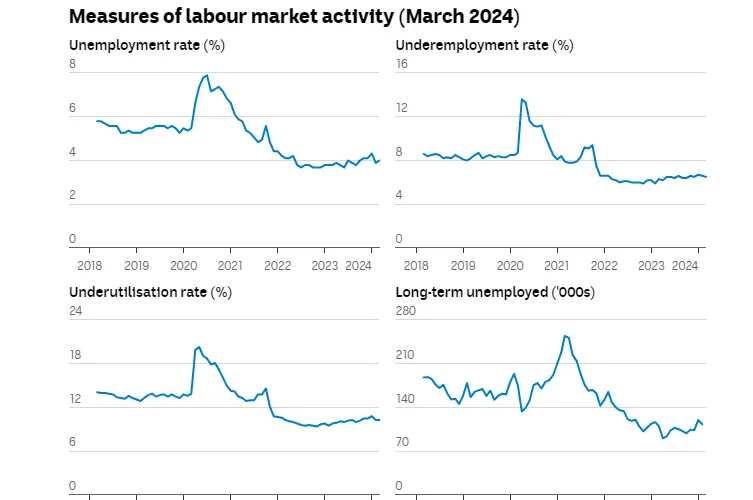

According to the section, RBA officials monitor a variety of metrics to assess the “tightness” of the labor market. These indicators collectively show that although the labor market remains tight, it has loosened somewhat since it was “very tight” in late 2022.

The graphic displayed the latest data on key labor market indicators (shown as blue dots), compared with data from periods of peak labor market tightness in October 2022 (orange dots) and average labor market conditions since 2000 (grey bars).

“The reduction in labor market tightness since late 2022 is primarily reflected in forward-looking measures, like firms’ intentions to hire,” noted the RBA Bulletin.

On Thursday, ANZ senior economist Blair Chapman observed that the labor market appeared to have “begun to relax” in March.

However, he mentioned that it might still be performing “slightly stronger” than what the RBA had predicted a few months back, and that a quicker rise in unemployment might be necessary in the upcoming months for the RBA to achieve its inflation objectives.

This ongoing tightness in the labor market, together with persistent high inflation and cost-of-living challenges, continues to create difficult conditions for many businesses.

Dr. Corbin Barry, a dentist based in Sydney, mentioned that he has been struggling to hire support staff who are willing to commit for the long haul.

Mr. Aird noted that heightened competition in the labor market is impacting the growth of advertised salaries.

He mentioned that according to Seek, advertised salaries increased by 0.2 percent in February, mirroring the growth rate of January. These represent the slowest monthly salary growth rates since December 2021,” he explained.

He added, “This aligns with a softening labor market. It will also contribute to slowing wage increases in 2024, aiding in the process of disinflation.”

EY senior economist Paula Gadsby anticipated that the March unemployment figures would start to offer a more distinct understanding of the fundamental conditions in the labor market.

She noted that changes in seasonal trends had affected the data during the first two months of the year.

“The labor market was still robust in March, with the Australia’s unemployment rate staying below 4 percent, the employment-to-population ratio near record highs, and an increase in hours worked,” she stated.

She also mentioned, “A slow relaxation in the labor market’s strength is anticipated as the impact of higher interest rates continues to permeate through the economy.”

Similar Posts

Unblocked Games 66: Unlocking Limitless Gaming Adventures and Fun

7 Pros and Cons of AI in the Workplace and Education

POS Systems Explained: Types, Features, Costs & How They Work (2025 Guide)